David Harris

Deb’s November Tip: Rollover Win: Sam Supports 4 Local Jewish Organizations

A Giving Strategies post by Deb Steinbuch

Many of those in our community over 70 and a half years of age have created endowment gifts using distributions from their IRAs. This gift creates benefits the community and offers a tax benefit for them. With the end of 2017 approaching, I wanted to share with you a relevant story.

We’ll call the donor Sam Henry. Sam turned 72 this year and had to take a required distribution from his IRA. Currently his IRA is valued at $950,000 so he has been withdrawing a little over $35,000 a year. The distribution was increasing the income taxes he owed and he and his wife didn’t need the money for living expenses.

After discussing options with his financial advisor, Sam learned that 2015’s permanent Tax Act permits rollovers from IRAs directly to most charities without recognition of income.

Sam does not need his IRA distribution and was looking for a creative way to help the Jewish community that has been so central in his life and that of his wife and children.

Sam, his financial advisor, and the endowment team at the Federation met. Sam decided on four organizations he wanted to support through his legacy gift; two were a continuing commitment; two new. The Federation put together an endowment agreement whereby the IRA would roll into this fund and the Federation would ensure that his legacy wishes for the community would be fulfilled upon his death.

Armed with this information, Sam instructed his IRA provider to make a $35,000 rollover distribution to the Federation directly into the brand new Henry Family Endowment fund. This fund is now set up to make annual gifts to the four organizations he cares about. To ensure that the organizations will continue to receive grants for many years, the fund is put into the endowment fund at the Federation and a percentage of the total will be distributed to the designated organizations, as stated in his agreement, each year in perpetuity. Sam told us he plans to continue to make IRA rollover gifts in future years to this fund to satisfy his required minimum distribution, increasing the amount available for the charities he wants to sustain.

Sam told us that he and his wife were pleased by the win/win result: resolving the tax problems of the required IRA distribution, and supporting their beloved Jewish community. They know their gift will last forever.

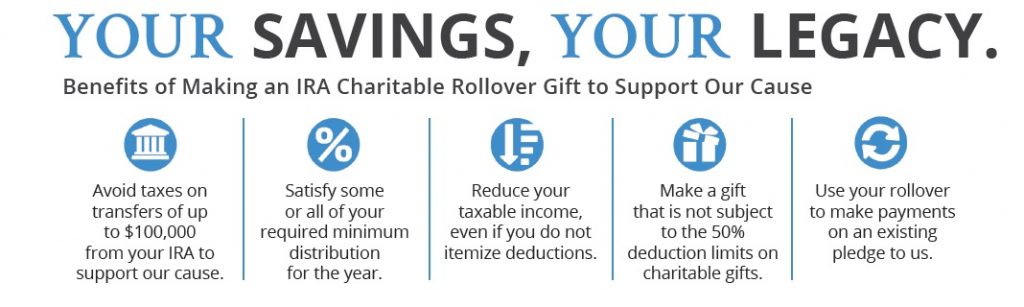

If you are eligible, please keep in mind the following information:

You can use your IRA to make a charitable gift that is excluded from your gross income and counts towards your required minimum distribution. While not eligible for an income tax deduction, the amount of the rollover gift will not be included in your Adjusted Gross Income.

Restrictions:

—You must be 70 1/2 or older at the time of the gift

—The transfer must go directly to the charity from the IRA

—The total IRA rollover gifts cannot exceed $100,000

—The gift must be outright to the charity

—The gift must be received by the charity, or postmarked, by December 31, 2017 for a 2017 gift.

Learn more about the benefits of a charitable IRA rollover here.

You can reach Deb Steinbuch, Planned Giving and Endowment Manager at the Jewish Federation, at 513-985-1593 or dsteinbuch@jfedcin.org. You can reach the Jewish Federation’s Create Your Jewish Legacy team here and the community-wide Create Your Jewish Legacy initiative here.

What’s the best way to give back? Our Giving Strategies Library offers smart, practical giving strategies show you how.