David Harris

Giving Strategies: Insuring the Funding of the Future

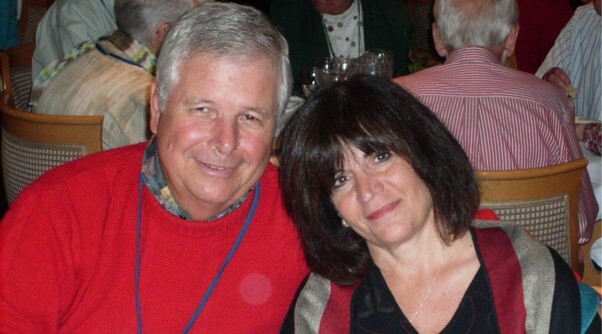

“The conversation about legacy began with our trip to Israel in 2016,” explained Deb Wacksman. “It was a trip organized by the Jewish Federation of Cincinnati and included all of the synagogues in the Cincinnati area. It was such a wonderful experience, provided by a wonderful organization, and we felt we needed to give back.”

Deb and her husband Jeff have been longtime givers to the Federation, but they wanted to make sure their gifts would continue well into the future. That’s when the couple reached out to the Create Your Jewish Legacy team at the Federation to find out how they could set up their legacy.

There are many ways the Wacksmans could have chosen to fund their legacy, but they opted to do so through a new life insurance policy. “I think using a life insurance policy is a very good way to fund something like this,” said Jeff. “The money doesn’t come out of your day-to-day expenses, and it makes it easier to give a large amount of money that you may not have sitting in the bank someplace. Then after a period of time, 10 years or so, the life insurance is funded, and the great thing about this is you can see it running while you’re still alive—obviously the Federation won’t feel the total impact of this for a number of years, but on the other hand, they know it’s going to be there. I think it’s an excellent idea for a legacy.”

Deb added, “I think it’s also a good way for young professionals to begin to think about starting a legacy. It’s really beneficial, because the younger you are when you take out a life insurance policy, the smaller the premiums are. So while younger people may not have the extra money to give monthly, or have a large lump sum to set up a legacy, this gives them a way to support the things that are important to them.”

Setting up a legacy gift via a life insurance policy is also a great way to leave a legacy and not impact your family’s potential inheritance. “I love knowing that my children will still be taken care of,” said Jeff. “The money that is going to them is different from the money that is going to the legacy fund. It helps remove any potential conflict with your kids.”

When asked what they hope for the future of the Jewish community, both Jeff and Deb said they hope it continues to expand and be more welcoming and inclusive. “I hope our legacy fund helps expand and enlighten people about the traditions and the values of Judaism,” said Deb, who is in the interesting position of not being Jewish herself.

She married Jeff in 1992 after his first wife, Bea Yosafat Wacksman, passed away. “I wanted to be there for Jeff’s kids in every capacity that they needed me, and I wanted to continue their Jewish heritage and traditions. I still identify as Methodist, but I am probably in synagogue more than I’m in church. When I am in church, our pastors will often go back to our Jewish heritage and say we do this because of our Jewish ancestors. I like to think that no matter our beliefs, or what we look like, we’re all the same on the inside. We’re all humans that deserve love and care and respect.”

While the Wacksmans created a new policy, many people acquire life insurance to help fund family and personal needs in case they don’t live as long as they hoped. Fortunately, many people outlive their worst-case scenario. The typical result is that the insurance contract is in force, paid regularly, or maybe even paid up, and growing in value. In the meantime, perhaps other assets grow to the point where the protection that was sought through life insurance isn’t as important.

That nearly forgotten life insurance policy could add significantly to the Create Your Jewish Legacy initiative, be given to support a program, activity, or agency in the Jewish community, or be used to set up a future endowment—it’s as easy as changing the beneficiary to the nonprofit(s) you want to support. In addition to the gift itself, there could be a tax deduction advantage with a gift of a life insurance policy.

Life insurance policies are just one vehicle that can be used to fund a legacy gift. For more information about making your legacy commitment, contact Debra Steinbuch, Director of Planned Giving and Endowment/CYJL at 513-985-1593 or dsteinbuch@jfedcin.org, or Jim Friedman, Director of Planned Giving and Endowment at 513-985-1524 or jfriedman@jfedcin.org.

Thanks for caring about our community and what we do.

Stay connected: sign up for our newsletter here.